All Categories

Featured

Table of Contents

- – Reliable Accredited Investor Crowdfunding Oppo...

- – Award-Winning Accredited Investor Crowdfunding...

- – Sought-After Accredited Investor Secured Inve...

- – Best-In-Class Exclusive Deals For Accredited ...

- – Professional Accredited Investor Investment ...

- – Comprehensive Real Estate Investments For Ac...

- – High-Value Investment Platforms For Accredit...

The guidelines for recognized financiers vary among territories. In the U.S, the meaning of an approved capitalist is presented by the SEC in Guideline 501 of Law D. To be a recognized capitalist, a person needs to have an annual revenue surpassing $200,000 ($300,000 for joint earnings) for the last 2 years with the expectation of earning the same or a greater earnings in the current year.

A certified capitalist needs to have a internet worth going beyond $1 million, either separately or jointly with a spouse. This amount can not include a key residence. The SEC likewise considers candidates to be recognized capitalists if they are basic companions, executive officers, or supervisors of a company that is providing non listed safeties.

Reliable Accredited Investor Crowdfunding Opportunities

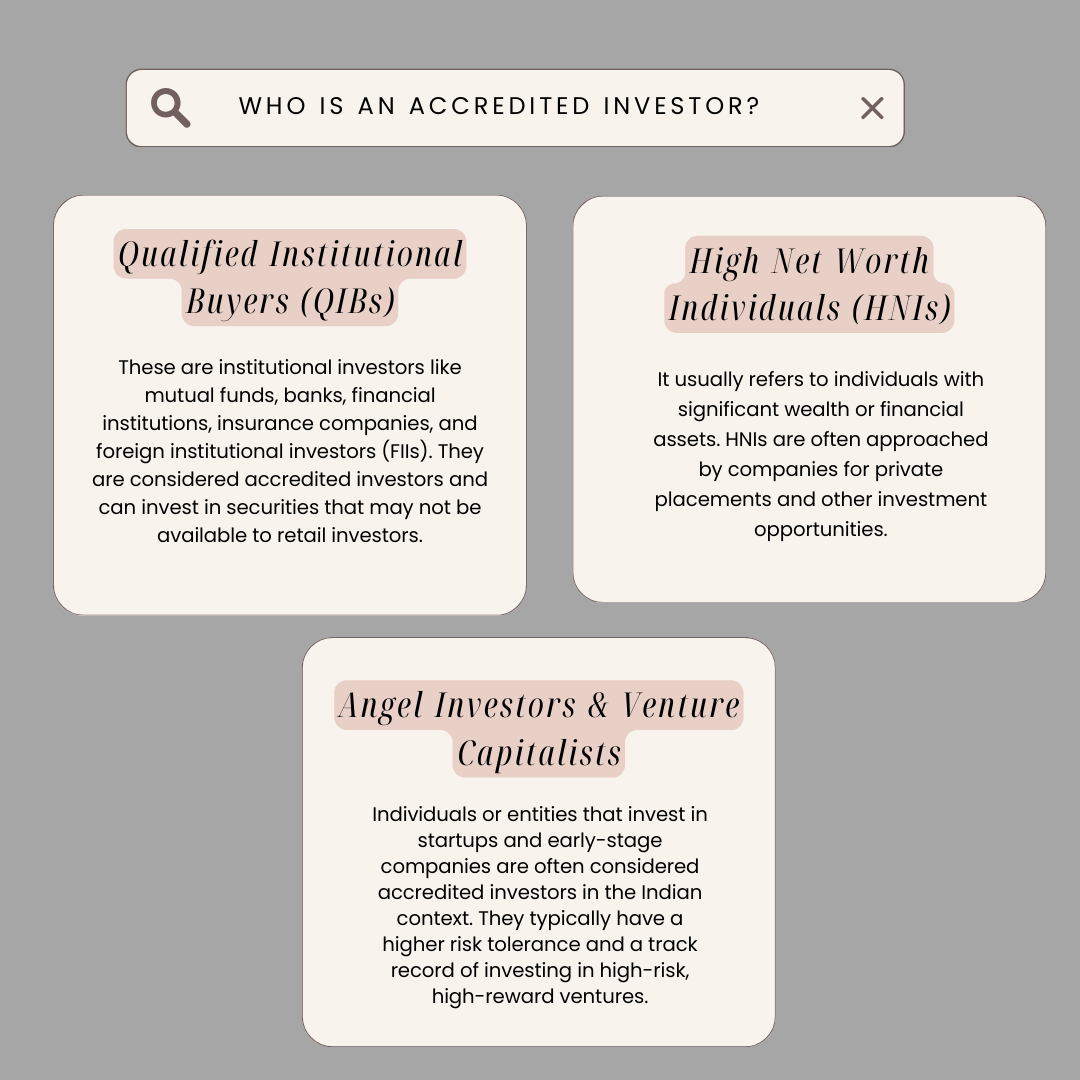

If an entity consists of equity proprietors who are certified investors, the entity itself is an accredited investor. An organization can not be created with the single objective of buying specific protections. A person can qualify as an approved financier by showing enough education and learning or job experience in the economic industry

Individuals who intend to be approved investors don't put on the SEC for the classification. Instead, it is the obligation of the firm using a personal placement to make certain that all of those approached are certified financiers. People or celebrations that intend to be accredited investors can come close to the issuer of the non listed protections.

Intend there is a private whose earnings was $150,000 for the last 3 years. They reported a primary home worth of $1 million (with a home loan of $200,000), an auto worth $100,000 (with an exceptional car loan of $50,000), a 401(k) account with $500,000, and a cost savings account with $450,000.

This individual's internet worth is specifically $1 million. Given that they meet the net well worth demand, they qualify to be a recognized capitalist.

Award-Winning Accredited Investor Crowdfunding Opportunities

There are a few less typical qualifications, such as handling a depend on with even more than $5 million in possessions. Under federal protections regulations, just those who are accredited investors might take part in specific protections offerings. These might include shares in exclusive positionings, structured products, and private equity or hedge funds, to name a few.

The regulators desire to be certain that participants in these extremely dangerous and complicated financial investments can look after themselves and judge the risks in the lack of government defense. The certified financier guidelines are made to protect prospective financiers with restricted monetary knowledge from adventures and losses they might be ill outfitted to withstand.

Recognized financiers satisfy qualifications and expert criteria to gain access to exclusive financial investment opportunities. Certified investors must fulfill earnings and web worth requirements, unlike non-accredited people, and can invest without restrictions.

Sought-After Accredited Investor Secured Investment Opportunities

Some vital changes made in 2020 by the SEC include:. This modification identifies that these entity types are commonly utilized for making investments.

These modifications increase the recognized capitalist swimming pool by approximately 64 million Americans. This broader gain access to supplies much more opportunities for financiers, yet likewise boosts possible threats as less financially innovative, investors can get involved.

One significant advantage is the chance to buy positionings and hedge funds. These investment options are special to certified capitalists and organizations that certify as a certified, per SEC policies. Personal placements enable business to protect funds without browsing the IPO procedure and regulative documents required for offerings. This provides recognized capitalists the possibility to buy emerging companies at a stage before they consider going public.

Best-In-Class Exclusive Deals For Accredited Investors with High-Yield Investments

They are considered as investments and come only, to certified clients. Along with known firms, certified capitalists can choose to spend in startups and promising endeavors. This provides them tax returns and the opportunity to enter at an earlier stage and potentially enjoy benefits if the company thrives.

For investors open to the dangers included, backing start-ups can lead to gains (high yield investment opportunities for accredited investors). A number of today's technology business such as Facebook, Uber and Airbnb came from as early-stage start-ups sustained by accredited angel capitalists. Sophisticated financiers have the possibility to discover investment alternatives that might generate much more earnings than what public markets use

Professional Accredited Investor Investment Funds

Although returns are not guaranteed, diversification and profile improvement alternatives are expanded for investors. By diversifying their profiles via these broadened investment methods recognized capitalists can improve their techniques and potentially accomplish superior long-term returns with correct threat administration. Experienced investors frequently come across financial investment alternatives that may not be quickly available to the basic capitalist.

Investment choices and safety and securities provided to approved financiers typically entail greater threats. For example, exclusive equity, equity capital and bush funds commonly concentrate on spending in properties that lug threat yet can be sold off conveniently for the opportunity of greater returns on those dangerous investments. Looking into before spending is essential these in scenarios.

Lock up periods stop capitalists from withdrawing funds for more months and years on end. There is likewise much much less openness and regulative oversight of private funds compared to public markets. Capitalists may battle to precisely value private possessions. When handling threats certified capitalists need to assess any type of exclusive investments and the fund supervisors involved.

Comprehensive Real Estate Investments For Accredited Investors

This adjustment may extend certified financier standing to an array of individuals. Updating the earnings and asset criteria for inflation to ensure they show changes as time proceeds. The present thresholds have stayed fixed considering that 1982. Permitting companions in dedicated partnerships to incorporate their resources for shared eligibility as recognized investors.

Enabling people with particular expert qualifications, such as Series 7 or CFA, to qualify as recognized financiers. This would certainly identify financial class. Producing additional requirements such as evidence of monetary literacy or efficiently finishing an approved financier test. This can make certain investors understand the threats. Limiting or getting rid of the key house from the net well worth estimation to decrease potentially filled with air assessments of riches.

On the other hand, it could additionally result in skilled capitalists assuming excessive dangers that may not be suitable for them. Existing accredited financiers might deal with raised competitors for the ideal financial investment opportunities if the swimming pool expands.

High-Value Investment Platforms For Accredited Investors

Those that are currently considered recognized investors must stay upgraded on any changes to the standards and laws. Companies looking for accredited investors must remain cautious concerning these updates to guarantee they are drawing in the ideal target market of capitalists.

Table of Contents

- – Reliable Accredited Investor Crowdfunding Oppo...

- – Award-Winning Accredited Investor Crowdfunding...

- – Sought-After Accredited Investor Secured Inve...

- – Best-In-Class Exclusive Deals For Accredited ...

- – Professional Accredited Investor Investment ...

- – Comprehensive Real Estate Investments For Ac...

- – High-Value Investment Platforms For Accredit...

Latest Posts

Government Tax Foreclosure Listing

Excess Sales

Delinquent Property Tax List

More

Latest Posts

Government Tax Foreclosure Listing

Excess Sales

Delinquent Property Tax List