All Categories

Featured

Table of Contents

- – Tailored Accredited Investor Wealth-building O...

- – Accredited Investor Platforms

- – High-Quality Exclusive Deals For Accredited I...

- – Most Affordable Accredited Investor Crowdfund...

- – Strategic Exclusive Deals For Accredited Inv...

- – Exclusive Private Placements For Accredited ...

- – Accredited Investor Passive Income Programs

The policies for certified investors vary among territories. In the U.S, the meaning of a recognized capitalist is placed forth by the SEC in Rule 501 of Law D. To be an accredited investor, an individual must have an annual income surpassing $200,000 ($300,000 for joint earnings) for the last two years with the expectation of making the very same or a higher revenue in the present year.

An accredited financier must have a total assets surpassing $1 million, either individually or jointly with a partner. This quantity can not consist of a main house. The SEC additionally considers candidates to be recognized capitalists if they are basic companions, executive police officers, or directors of a firm that is providing non listed safety and securities.

Tailored Accredited Investor Wealth-building Opportunities for Accredited Investors

If an entity consists of equity proprietors who are certified capitalists, the entity itself is a certified financier. An organization can not be formed with the sole purpose of acquiring specific safeties. An individual can certify as a recognized capitalist by showing enough education or work experience in the economic sector

Individuals that wish to be recognized financiers do not relate to the SEC for the classification. Instead, it is the duty of the company providing a personal positioning to ensure that all of those come close to are certified investors. People or events who desire to be accredited financiers can come close to the company of the unregistered securities.

Expect there is a private whose earnings was $150,000 for the last 3 years. They reported a main home worth of $1 million (with a mortgage of $200,000), an automobile worth $100,000 (with a superior funding of $50,000), a 401(k) account with $500,000, and a savings account with $450,000.

Total assets is computed as assets minus responsibilities. He or she's web worth is precisely $1 million. This entails a computation of their possessions (aside from their main residence) of $1,050,000 ($100,000 + $500,000 + $450,000) less an auto loan equaling $50,000. Since they satisfy the net well worth demand, they certify to be an accredited financier.

Accredited Investor Platforms

:max_bytes(150000):strip_icc()/accreditedinvestor_final-f821797e377f4f5aaf1310f1f47d181d.jpg)

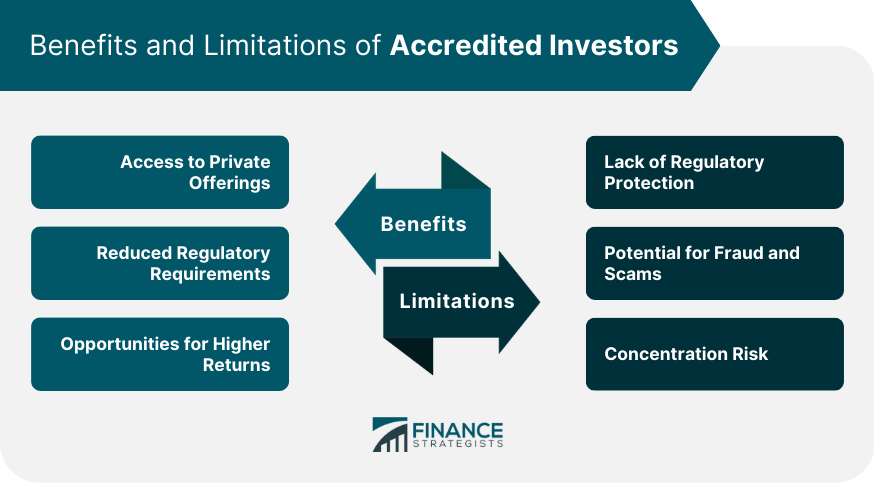

There are a few less typical qualifications, such as taking care of a count on with even more than $5 million in possessions. Under federal protections legislations, only those that are accredited capitalists may take part in particular securities offerings. These may consist of shares in private placements, structured items, and exclusive equity or bush funds, among others.

The regulators wish to be specific that individuals in these highly dangerous and intricate financial investments can look after themselves and judge the dangers in the lack of federal government security. The certified capitalist rules are created to shield possible financiers with minimal monetary knowledge from adventures and losses they may be sick geared up to withstand.

Certified financiers meet qualifications and specialist requirements to access special financial investment possibilities. Accredited financiers should satisfy income and net well worth requirements, unlike non-accredited individuals, and can invest without limitations.

High-Quality Exclusive Deals For Accredited Investors

Some essential changes made in 2020 by the SEC include:. This modification acknowledges that these entity types are frequently made use of for making financial investments.

This adjustment make up the results of rising cost of living gradually. These amendments broaden the recognized investor pool by about 64 million Americans. This broader accessibility provides extra opportunities for capitalists, however additionally enhances prospective dangers as much less financially sophisticated, capitalists can participate. Organizations utilizing personal offerings may take advantage of a bigger pool of possible capitalists.

These financial investment options are special to accredited capitalists and organizations that qualify as a recognized, per SEC laws. This offers accredited investors the opportunity to invest in arising business at a phase prior to they consider going public.

Most Affordable Accredited Investor Crowdfunding Opportunities

They are deemed financial investments and are easily accessible only, to qualified clients. Along with well-known companies, certified financiers can choose to invest in start-ups and up-and-coming endeavors. This provides them income tax return and the possibility to get in at an earlier stage and potentially gain benefits if the firm prospers.

However, for financiers open up to the threats involved, backing start-ups can result in gains. Much of today's tech business such as Facebook, Uber and Airbnb stemmed as early-stage startups sustained by approved angel capitalists. Innovative capitalists have the opportunity to discover financial investment alternatives that may produce much more revenues than what public markets use

Strategic Exclusive Deals For Accredited Investors for Financial Growth

Although returns are not ensured, diversification and profile enhancement alternatives are increased for capitalists. By expanding their portfolios via these increased financial investment opportunities certified capitalists can boost their techniques and potentially accomplish premium long-term returns with correct threat management. Skilled capitalists usually run into financial investment options that may not be conveniently readily available to the basic financier.

Investment options and safety and securities supplied to approved financiers usually include higher threats. Personal equity, endeavor funding and hedge funds often focus on spending in assets that lug risk however can be sold off conveniently for the possibility of higher returns on those risky financial investments. Looking into prior to investing is crucial these in situations.

Lock up periods avoid capitalists from withdrawing funds for more months and years on end. There is additionally far less openness and regulatory oversight of exclusive funds compared to public markets. Financiers may struggle to precisely value private properties. When dealing with threats certified capitalists require to examine any personal financial investments and the fund supervisors included.

Exclusive Private Placements For Accredited Investors for Accredited Investors

This adjustment may prolong accredited financier condition to an array of individuals. Allowing partners in dedicated partnerships to incorporate their resources for common eligibility as accredited capitalists.

Enabling individuals with certain specialist certifications, such as Series 7 or CFA, to qualify as recognized investors. Creating extra demands such as proof of financial proficiency or successfully finishing a certified investor exam.

On the various other hand, it can also result in seasoned investors thinking extreme dangers that may not appropriate for them. So, safeguards might be required. Existing recognized capitalists may encounter boosted competitors for the very best financial investment chances if the swimming pool expands. Business increasing funds may take advantage of an expanded certified capitalist base to draw from.

Accredited Investor Passive Income Programs

Those who are currently considered accredited investors should remain upgraded on any kind of alterations to the criteria and guidelines. Services looking for certified capitalists should remain watchful concerning these updates to guarantee they are drawing in the ideal audience of financiers.

Table of Contents

- – Tailored Accredited Investor Wealth-building O...

- – Accredited Investor Platforms

- – High-Quality Exclusive Deals For Accredited I...

- – Most Affordable Accredited Investor Crowdfund...

- – Strategic Exclusive Deals For Accredited Inv...

- – Exclusive Private Placements For Accredited ...

- – Accredited Investor Passive Income Programs

Latest Posts

Government Tax Foreclosure Listing

Excess Sales

Delinquent Property Tax List

More

Latest Posts

Government Tax Foreclosure Listing

Excess Sales

Delinquent Property Tax List